Premier League Profit & Sustainability rules for 2015/16

Premier League Profit & Sustainability rules for 2015/2016 4 Jan 2016

For the current season (2015/16) there are two elements to the Premier League’s financial constraint regulations. The rules can be found within the 2015/2016 Premier League Handbook.

The Premier League shy away from calling these rules ‘Financial Fair Play’ but they have pretty-much the same aim: a set of rules and regulations to ensure financial sustainability. The two elements are:

1. Profit & Sustainability

2. Short Term Cost Control (STCC)

Profit and Sustainability rules ensure that clubs don’t make unacceptably high financial losses, and that club debts do not grow significantly.

STCC rules is concerned with ensuring that clubs don’t blow their bumper TV deal on wages (therefore ensuring club aren't vulnerable if the next TV deal is reduced, or if the club gets relegated).

I will cover Short Term Cost Control in a separate article – this article looks at how the Profit and Sustainability rules work.

The Premier League rules for calculating any overspend is not easy to understand. The rules use a system of lettering; the key thing to understand is that the season in which a potential overspend is calculated is called 'T' - we can think of 'T' as the current playing season (i.e. 2015/2016)

In the Premier League, any overspend is assessed during 'T' (with all clubs required to submit projected figures for the current season by 1 March). Because the current season hasn’t yet finished, this March submission includes a forecast for the financial loss (or profit) that the club expect to make during ‘T’ (i.e. this season). This March submission, also needs to include the actual figures for profit or loss that they made in the two previous season (T-1 and T-2). Total losses are therefore assessed over three seasons (T, T-1 and T-2).

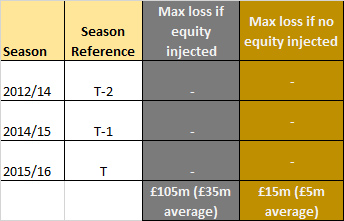

There is maximum permitted loss figure which clubs cannot exceed over the three seasons combined. This figure differs depending on whether the club owners inject equity to cover the amount of any loss. The maximum permitted loss over the three years is £105m (with only £15m permitted if the owner does not inject the equity).

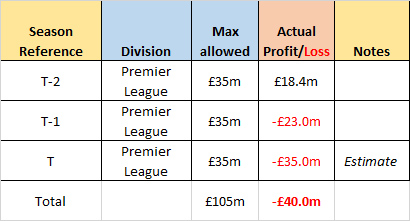

To understand this better, let's look at the example of Chelsea. Chelsea have had back-to-back seasons in the Premier and can lose up to £105m over the three seasons. We can make an educated guess as to how their figures will look when they make their return to the Premier League this season:

Chelsea:

The figures for T-2 and T-1 are actuals taken from the club accounts. We clearly don’t have the accounts for the current season (2015/16, i.e. ‘T’) but we can make an estimate for illustrative purposes. Although the club have a new sponsorship deal, unless they climb the table dramatically they will receive a lower share of the TV revenue this season. They also had to make a pay-off to Mourinho – hence a worsening loss looks quite likely. For illustrative purposes, let’s assume a £35m loss this season.

As we can see from the above table, although they haven’t come close to exceeding the £105m maximum loss figure, a loss of £40m over the three season does exceed the £15m figure. In this scenario, Chelsea's return (which they will submit by 1 March 2016), will show that they have exceeded the £15m limit by around £25m. As a result, the club owner will be required to provide 'Secured Funding' for £25m. 'Secured Funding' effectively means the owner has to make an injection of cash (equity) into the club or has to irrevocably mortgage specific liquid assets/funds up to the required value. There have been various interpretations of Abramovic's funding of Chelsea (and whether he has actually fully funded the club debts or not) - however these new rules mean that he will categorically have to fund aggregate losses over 2015/16 and the two previous seasons combined.

By exceeding the £15m limit, there will be a further requirement on the club; Chelsea will have until 31 March 2016 to submit projections for the next two seasons: T+1 and T+2 (2016/17 and 2017/18). Although the Premier League rules requires clubs to be as accurate as possible with their projections and not to make knowingly untrue projections, projections are subjective by their very nature. A club like Chelsea is likely to project a top 4 finish in 2016/17 and also probably predict that it will get beyond the Champions League Group Stages in 2017/18. Hence, their projections for T+1 and T+2 are likely to predict profits that effectively wipe-out the £40m loss (especially given the increase in TV revenue which starts next season). As a consequence Chelsea's owner will probably not be required to provide further Secured Funding) beyond the £25m outlined above.

It is worth pointing out that the £105m maximum loss figure is so large (especially given next season's TV deal) that a club would have to be reckless in the extreme to exceed it. However, if a club had reported a loss for T-2, T-1 and T combined which exceeded £105m, the club would immediately be in breach of the rules (even if the future projection showed that the club would come back within the limits over future seasons). Any club predicting a loss over T-2, T-1, T, and T+1 and T+2 combined that exceeds £105m would also be in breach of the rules (although that is even more unlikely).

Integration of Championship clubs

It is also worth looking at how the rules affect teams that have been promoted to the Premier League from the Championship:

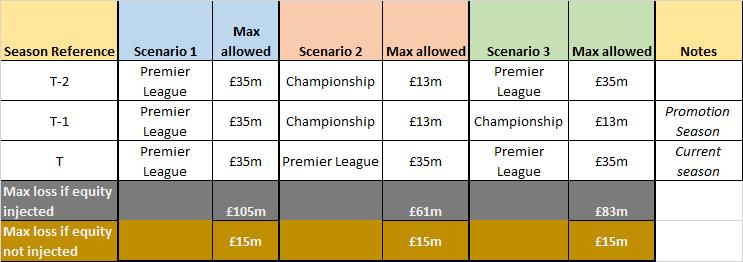

Following changes announced in 2014, the Championship rules have been 'dove-tailed' into the Premier League rules. From the end of 2014/15, any club promoted to the Premier League immediately falls within the Premier League rules. During their first season in the top flight ('T'), they will have to make a financial return to the Premier League to cover T, T-1 (their promotion season) and T-2. However, recently promoted clubs will be given a reduced ‘maximum loss' figure: rather than permit a club to lose an average of £35m a season, promoted clubs will be allowed to lose £13m for each season in the Championship. This diagram explains the allowable limits, based on the division the club was in for T-1 and T-2.

There are three possible scenarios:

This is probably best illustrated if we use a real example – let’s look at Bournemouth. Bournemouth fall into Scenario 2 above and are able to make losses totalling £61m over the three seasons.

Bournemouth:

Most of the figures for Bournemouth are estimated, but as we can see, the club don't have any real issue - they can expect to report a healthy profit this season and they should be within the £15m figure (and are significantly within their maximum permitted loss figure of £61m). If the club are below the £15m figure, the owner does need to inject any equity into the club. In addition, the club does not need to make a second return by the end of March 2016 to project their financial performance forward over T+1 and T+2

blog comments powered by Disqus