Liverpool – large cash injection from owners required under FFP rules

Liverpool recently reported a £40.5m loss the 2011/12 season (the first year of the initial FFP Monitoring Period). I have attached a table summarising the accounts, together with a projection for the next accounting period.

Not being a Liverpool supporter, I am grateful for the assistance of Mike Donald (@mdonald1987) for his help in pulling the above together and providing information on events at the club.

The good news for Liverpool fans is that the club appears to have turned a corner. Based on information announced by the club it looks like Liverpool's next published accounts (relating to the current season) will be a significant improvement on their £40.5m loss reported for the 2011/12 season. They look on course to lose around £15m for the 2012/13 season and are moving towards Break Even and potentially profit once the new TV deal kicks-in during the 2013/14 season.

The newly published accounts for 2011/12 are a little difficult to compare to previous results because Liverpool have changed their account cut-off dates as a consequence of changing their annual accounting period from end July to end May. Consequently, the recently released accounts cover 10 months rather than the usual 12. I should point out that the loss of £40.5m was very much in line with expectations. In May and Sept last year I produced a projection forecasting a£48m loss for the full 12 months –the shortened accounting period essentially explains the difference.

Interestingly, the change in the cut-off dates actually helps the club's financial results by around £10m net. The main difference relates to the fact that only 10 months of wage costs are now included (plus around £3m of other expenses). This reduces the expenses by around £23m. However this is partially offset by a reduction in Commercial Income to reflect the shorter reporting period which reduces income by around £13m. The other costs and revenues are shown on a full-year basis – hence the net benefit of around £10m.

This is particularly interesting because the FFP rules don’t specifically mention any restriction or requirement for the annual reporting period to cover a full 12 months. This looks like it might have been simple oversight by UEFA but means that Liverpool appear to be the first club to have successfully found and used a loophole to help club. Although Liverpool would have passed FFP without this change, it does help reduce the amount of equity that the club owners will need to inject into the club. I should point out that the accounting change was made with some justification and probably wasn’t simply a ruse by the owners. Now that clubs rely proportionately less on Season Ticket revenue and more on pre-season tours, it makes sense for the accounting cut-off to be at the end of May rather than July.

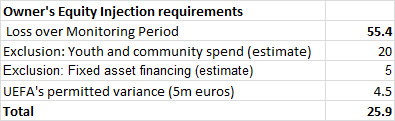

The Liverpool owners converted £47m of club debt to an interest-free loans last August. This is obviously a step forward but is a far-cry from the UEFA (and the Premier League’s new rules) that requires to convert losses to equity. The concept of converting debt to equity is not always well understood – essentially it works as follows: The club creates new shares which are then purchased by the owners. Consequently, the club gain an injection of cash which is used to ensure the debts do not grow further. All the owners gain is a piece of paper (share certificate) - the owners owned 100% of club shares prior to the change and still own 100% of club shares. By converting debt to equity in this way, the owner faces the very real prospect of losing their money entirely – crucially they also have to have the available liquid cash available to inject into the club. The owners will only get their money back if the sell the club (and then it depends on the sale price) or if the club make a profit in future and the club pay the owners a dividend. Understandably, converting debt to equity is not something owners want to do if they can help it. However Liverpool’s owners are going to have to put their hands in their pocket and do this to ensure they can apply for a UEFA licence. Clubs apply for a license in advance so we can be sure Liverpool will apply – however this requirement will mean Liverpool’s owners will have to put their hands in their pockets for around £26m to cover the two years of the first Monitoring Period (see table below).

The FFP rules allow certain types of expenditure to be excluded from the Break Even calculation. The exempted figures include spend on youth development and community spend. However club accounts currently don’t break down this spend and analysts have had to make guesses about how much this might be. Recently Man City intimated that it spent £10m on youth development and community spend in one year so £20m is probably a good estimate for Liverpool over the two years of the Monitoring Period. Of course, if the actual figure turns out to be less than £10m a season, the owners will need to inject a higher amount of equity.

The Post Balance Sheet Events (PBE) section of any accounts are always worth a read (often one of the final pages). This section tells us if anything significant that has happened since the cut-off for the accounts, up to the time the accounts were signed-off by the auditors. Here they report on events between 1 June 2012 and 28 November 2012 (i.e. the summer transfer window). Liverpool report that they made a loss on player trading of £8.4m over this period. This is interesting as the club only sold three players of note: Adam, Kuyt and Aquilani. The ‘loss on player trading’ figure relates to the difference to their selling price and their book value (i.e. amortised figure). It is difficult to see where the £8.4m book value loss came from for these players (it looks like the club may well have given Aquilani away on a free transfer). With no sales in January, this looks like the figure that will appear in the next year’s accounts (compared to a £1.7m loss on player trading in the newly published results, and a profit of over £40m the previous year).

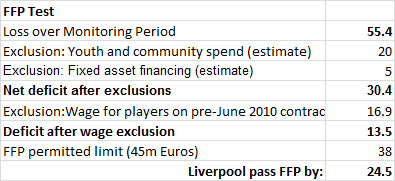

Although the club debt has grown from £65m to £87m, for the purposes of passing the FFP Break-Even test, debt is largely irrelevant. The Break-Even test just looks at whether the club has balanced incomings and outgoings. Having large debt will affect a club’s interest payments (and therefore have some bearing on the ability to Break Even) – however debt in itself is not a component of the UEFA test. I should point out that Liverpool will now have no problem passing the FFP test in the First Monitoring Period as shown in this table.

The important thing to remember for Liverpool is that the Warrior deal commenced in 2012/13 and will be in the next accounts – this will considerably help raise their commercial income. In future years, Liverpool, like all clubs will also benefit from the new TV deal (from 2013/14 for three years) which will raise income by around £20m-£30m. However, this new income would be partially offset by a loss of around £5m should the club fail to qualify for the Europa League. Overall, the club finances are beginning to look much healthier. In the long-term however, as the club directors continue to point out in the accounts, on-field performance is the key driver of off-field financial success.

blog comments powered by Disqus