Man City release controversial accounts

Manchester City's long-awaited financial results were released last week. In many ways they raise more questions than they answer.

As a number of journalists have pointed out, there are a host of Related Party Transactions, Inter-company transactions as well as a sale of Image Rights to a company that the City Press Office insists is outside the club. These obscure transactions have been designed to generate one-off income for the club during the final accounting year that will be covered by the first Monitoring Period. City have remained publically silent over whether they will actually pass the FFP Break Even test and curiously, the accounts don't even mention FFP or the potential for reduced income if they were to be excluded from future competition. Given that their thousands of fans are keen to know if the club have passed the FFP test, the club's silence seems remarkably remiss.

If UEFA's CFCB panel were to accept City's accounts on face-value and not contest any of the items, then it seems that City will just squeeze under the FFP limits (largely due to a transitional clause that allows them to exclude a huge chunk of wages paid in 2011/12 to players who originally joined the club before the FFP rules were voted-in).

However, the CFCB panel are required by the rules to review a number of transactions, totalling £35 m, which have been badged as 'Related Party Transactions' in the club accounts. The CFCB will attempt to identify and apportion a market rate to these transactions In addition, a number of other items could also conceivably be reviewed. These items:

- May be classified as Related Party Transactions by CFCB

- May not be considered 'Relevant Income' and will need to be excluded from the FFP Break Even test

The sale of Image Rights is both interesting and intriguing. The club has not disclosed precisely what they are trying to achieve. In their usual form, Image Rights are essentially a vehicle to avoid/reduce tax and National Insurance. For example a footballer will have a sum equal to up to 10% of their salary paid into an offshore company (often paying zero tax). The rationale is that, as a proportion of their earnings essentially come from use of their image overseas, there is no requirement to pay UK tax on the overseas earnings. HMRC cap this benefit at 10% of salary.

On the face of it, it looks like City are introducing a commercial company through which a percentage of their overseas earnings can channelled in order to reduce their tax liability. It looks like this company has paid Man City for 'Image Rights' so that they can collect their designated overseas earnings. Presumably this company will ultimately process the revenue off-shore so tax is greatly reduced on any profits. However, Manchester City have not made any profits for a number of years and as such have not had to pay Corporation Tax - any benefit from such an arrangement is therefore likely to come in future seasons. In an ideal world, the club should provide more information on what they are attempting here - it is possible that the club have simply sold a percentage of Image Rights to a completely separate company (as their Press Office seems to be suggesting). However, even if the rights revert to the main club after a defined period of time, this seems rather unlikely - why would City (a club with zero debt) genuinely want to sell a percentage of their future Image earnings? Depending on the rationale, it seems possible that CFCB may determine that the Image Rights payments do not represent 'Relevant Income' (a term that defines income generated from broadly football-related sources).

Man City have every reason to feel pleased with the performance of their accounting teams. Whereas PSG decided to fudge the Break Even test with a single commercial tie-in with the Qatar Tourist Authority (a deal that appears to be a fairly transparent Related Party Transaction), City have very deliberately adopted a much more complex approach. The CFCB will have unpick a multitude of Related Party Transactions, deals with associated companies; third party companies; Image Rights deals; a complex Naming Rights and sponsorship/development deal, in addition to further sponsorship deals from parties connected (if not 'Related') to the owner. You have to wonder whether CFCB will have the desire and tenacity to unravel and challenge each element

Above - how one Arsenal supporter viewed City accounts

City's increase in Commercial Income is also intriguing. Their non-Broadcast Commercial Income increased by a huge £36m (from £107m to £143m) and it is difficult to understand where this comes from. It is the convention for club websites and publications to list club partners/sponsors in order of their contribution to the club - City list their top sponsors/partners in order as Etihad, Nike, Etisalat, TCA Abu Dhabi and aabar. Four of their five top sponsors are from parties connected to the club owner (Mansour is part of UAE's absolute monarchy which effectively controls all government and all state-owned assets). The only non-Mansour-related partner in their top five appears to be Nike (who are reportedly paying £12m a season, a £6m increase from the previous season). The remaining key-partners were all sponsoring the club during 2012/13 and none are new. As I say, it is difficult to say where the £36m increase in commercial income has come from. The CFCB will presumably want to know and depending on the answer this might open up the debate of Related Party Transactions.

The suspicion arises that various Image Rights and intellectual property deals were essentially 'balancing items' and that these deals would have appeared in their accounts for however much City needed to nominally pass the test. Interestingly, Mancini was sacked just three-weeks before the end of the accounting cut-off date. His pay-off resulted in a one off charge in the club accounts for at least £7.5 m (quite possibly considerably more). City's accountants would have us believe that if the sacking had not happened, the club would have reported a very healthy and somewhat implausible FFP pass. One of City's 'Intellectual Rights' deals apparently included in their accounts (Melbourne Hart women's team) was only announced this month; this rather gives the game away.

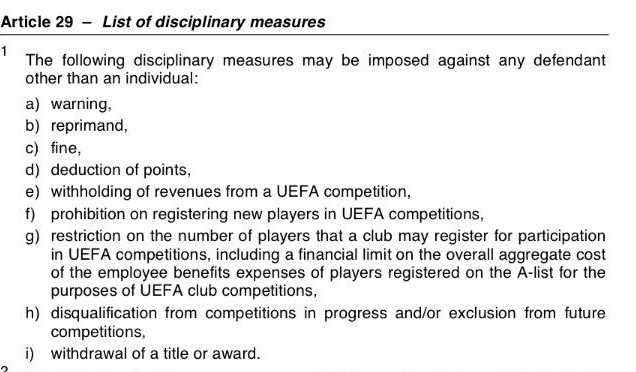

So, what does this mean for City? The most likely scenario is that the CFCB will challenge most of the contentious items and that some will be overruled. City's FFP pass will be turned into an FFP failure. It seems likely that UEFA will use their newly beefed-up FFP sanction for City (and PSG) - see below for extract. This sanction enables UEFA to withhold players from their competitions based on their overspend. So, if for example, City are ruled to have failed FFP by £20m, the club will have to field a Champions League Squad without a number of players who are paid a total of £20 m in wages. The mechanics of this punishment are still be outlined but UEFA seems happy that this provides a punishment that is directly proportionate to a club's overspend. Unlike an outright ban, this punishment would insulate them from any later legal challenge and claim for damages (i.e. should FFP be eventually overturned via the Striani case).

blog comments powered by Disqus