Will Chelsea pass the FFP test?

Posted by Ed Thompson on Wednesday, October 3, 2012

There have been some distinctly mixed messages coming out of Chelsea regarding FFP. On one hand, the club have spent lavishly on players such as Hazard and Oscar but on the other, the club has declared their commitment to FFP. In a recent club statement, Chief Executive Ron Gourlay announced that the was 'in favour of rules promoting financial stability' and added that 'from Chelsea's point of view, we have been working very hard to comply with FFP criteria,'

This will have left football followers rather confused over a key question; are high-spending Chelsea set to pass the FFP test?

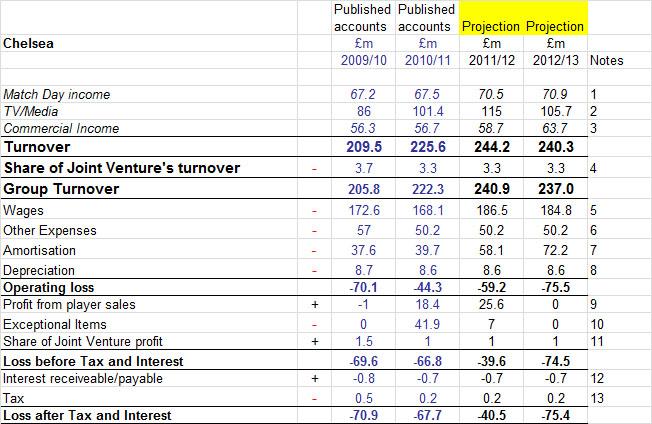

It takes some effort to pull the information together. Fortunately most of the relevant information has been reported on by sports journalists and it is possible to make pretty good assumptions about the missing information. Some of the calculations are complicated, but they can't be done. After collating all the figures, the projection for Chelsea's financial results in 2011/12 and 2012/13 look like this:

Note:

The last published accounts go up to 30 June 2011 - everything after that date is a projection. I have put a full break-down of the rationale and calculations for all the projected figures on a separate page (link) on this site - use the Notes Ref to look up the item you are interested in. Also, if readers are not familiar with the term 'amortisation' and how transfer fees are written-down, please watch this short video.

The final projected loss figure shown in the table (loss of £40.5m for 2011/12 and loss of £75.4m for 2012/3) is not the final figure that will be used to determine FFP compliance against the Break Even rules - certain expenses can be excluded from the calculations and I explore the FFP impact of the headline loss figures later in this article.

The first items to note are the overall loss figure for 2011/12 and 2012/13. Losses were reduced significantly from 2010/11 (£67.7m) to 2011/12 (£40.5m). The club will no-doubt highlight the improvement when the accounts are finally released (probably in January/February next year). However, owing to the club's increased spending, the loss is set to increase rather dramatically during the 2012/13.

2011/12 figures

Chelsea recorded huge one-off Exceptional costs of £41.9m in the last published accounts. This mainly related to firing Ancelotti and hiring AVB. The £7m figure above includes £2m for firing AVB (this would have been around £14m if Spurs had not re-employed him - link), plus a marker of £5m for the abortive new stadium proposal. We don't need to worry too much about the £5m figure as it can be excluded from the FFP Break Even calculations. Without the huge Exceptional item in 2010/11 the figures would look much healthier and the number-crunchers will have been relieved that Abramovic chose to recruit the low-cost De Matteo.

As we all know, during 2011/12 Chelsea won the Champions League and the FA Cup - this has added significant commercial income to the club. However the club also spent heavily and the wages have increased from £168.1 to £186.5m. Amortisation (the write-down of transfer fees over the duration of the contact) has also increased from £39.7 to £58.1. The increase in player costs mainly relate to Mata, Lukaka, Meireles, plus Torres and Luiz who were signed part-way through the previous season.

As I pointed out above, if you want to see the detail behind the figures go to the separate pages of figures here.

During 2012/13 Chelsea again made another profit from player sales. The profit figure of £25.6 is detailed as a Post Balance Sheet Event in the last published accounts.

2012/13

These figures have been produced on the assumption that the club finish third in Premier League (Chelsea are currently third favourites for the title with the bookies) and match their 2011 Champions League by reaching the Quarter Final.

I have assumed that the club are spared any Exceptional items during the current season (presumably De Matteo's job is fairly secure). The worsening financial position (projected loss of £75.4m) is due to a number of factors:

- Lack of profit made from player sales - the club have previously received healthy income from player sales made for above their Book Value. However the club doesn't appear to have made a profit on any player sales during Summer 2012.

- Further increased amortisation and wage cost, largely as the result of Summer 2012 spending.

- Reduction in Champions League prize money in 2012/13 compared to 2011/12.

Financial Fair Play impact

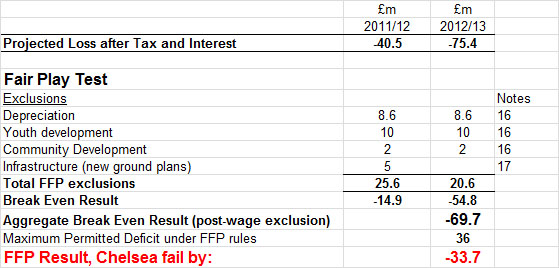

The FFP Break Even rules require clubs to report a maximum loss of around £36m over the two-year monitoring period 2011/12 and 2012/13 (future Monitoring Periods look at the results over three years). A number of expenses are excluded from the FFP Break Even test and once removed Chelsea's FFP projection looks like this:

Chelsea look set to fail the test by around £33.7m - i.e. around 94% over the permitted £36m loss.

Significantly Chelsea cannot make use of the provision that would enable them to deduct the cost of wages for players signed before June 2010. This clause is explored in detail here, but for Chelsea the issue is that the wages for long-standing players can only be deducted if losses are decreasing each year. Owing to increased wage and transfer spending, the total losses 2012/13 will actually increase. If they had been able to use this exemption, all the 2011/12 losses could have been wiped-out, for FFP purposes, and Chelsea would have passed the FFP test.

What next for Chelsea?

The above projection is based on the club's current position. The position probably isn't irretrievable for the first Monitoring Period. A new, large commercial deal could change things quickly. Chelsea have been reportedly looking for buyers to Stadium Naming Rights and this seems the most likely way for the club to solve their immediate problem. A deal for, say, £30m a season deal would fairly swiftly resolve their FFP deficit. Rather tellingly, Gourlay announced 'We have been very active commercially as we strive to meet the obligations of FFP'. Stadium Naming Rights really looks like a very likely scenario for Chelsea - although how valuable the rights would be if the club are still looking to move, remains to be seen.

Like City, Chelsea are most exposed in respect of FFP during the first few Monitoring Periods. For the seasons after 2012/13, the new Premier League TV deal will help significantly and overseas Media deals also appear to be about to increase. Having said that, the permitted FFP Break Even deficit is just £24m total during 2012/13/ 2013/14 and 201/15 combined. Chelsea are currently a long way adrift of that figure.

It is important to remember that player sales in January would probably not solve Chelsea's entire FFP problem. In the club accounts, only the profit over the player's Book Value counts towards the clubs losses or profits. So, although Hazard could probably be sold for £30m in January, his written-down book value will be around £29m at that time so that would result in a book profit of only £1m. However, other players with lower book values could, of course, be sold (resulting in trading profits plus reduced wages and lower amortisation). However, with the close proximity to the end of the first Monitoring Period, it will be interesting to see how much money is spent in January - it is quite possible that clubs will rein in their spending in January.

Chelsea's will also be looking closely at the likely punishments imposed by UEFA. As I outlined in this article, a senior UEFA official has inferred that clubs may not get a Champions League ban for their first transgression - any club that exceeds the initial limits by more than 20% may simply have a restriction imposed on the number of players they can register for the Champions League. Although that would have a certain impact, that kind of low-level punishment would probably be privately welcomed by the club. However, this approach is still to be confirmed and it will be interesting to see if UEFA bracket all clubs that exceed the limit by 20% together, irrespective of the size of the deficit.

blog comments powered by Disqus