Will City pass the FFP test? Part 1

Following the dramatic events at the Etihad, I have received lots of interest from people asking the same question: “Will City pass the Financial Fair Play test?” To answer this question you need to make a large number of assumptions about the club’s footballing and financial performance. The assumptions that I have used are outlined in the Notes section but in summary they include the following main assumptions:

- City continue their success and win the Premier League, FA Cup and reach the Champions League final next year

- City continue their extraordinary 25% year-on-year growth in Commercial income (topping £100m in 2012/13)

- City make no major sales or purchases next season (this prediction is probably unlikely but it provides a base to work from).

As with all projections, there are huge number of variables and each one is open to challenge. However the club accountants will also be wresting with many of the same predictions regarding, League position, Champions League performance, and even the Euro exchange rate.

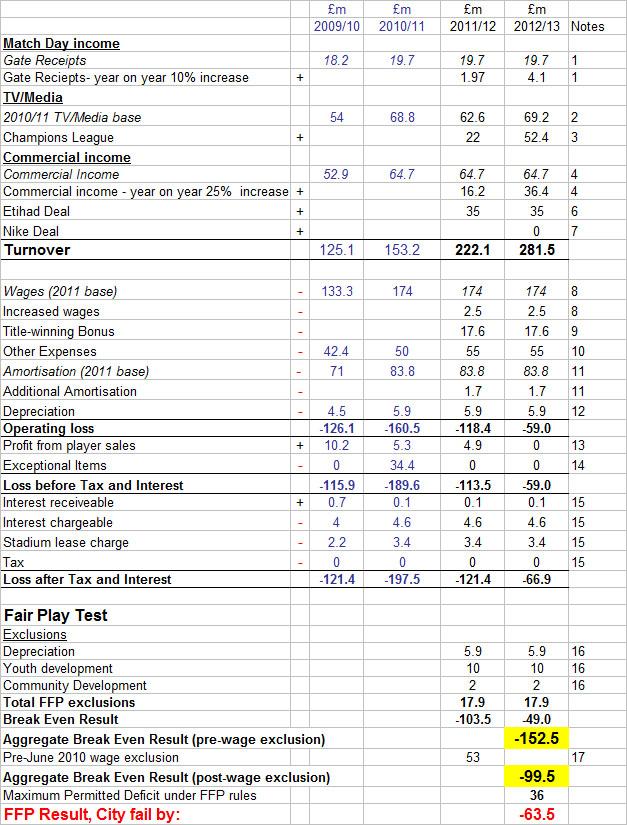

Projection (£m):

My projection has City failing the FFP test for the first Monitoring Period by £63.5m. See also the technical note below under heading Annex X1 regarding this figure.

An explanation of the rationale behind each figure is contained in the Notes section (Part 2 of this article).

I have used a mixture of known information and 'best case' assumptions for the projection. If I had assumed a less successful season where they only reached the last 16 of the Champions League and did not win the FA Cup, City would be £32m worse off and would fail the FFP test by £99.5m.

The projection shows the actual figures in the published accounts for 2009/10 and 20010/11.

Understanding Financial Fair Play

I recommend that readers not overly familiar with FFP rules watch the 6 minute video that explains FFP.

How can City get over the line?

City’s main problems are going to be in the early years of FFP. After that, it is possible that they have built such an efficient Commercial machine that they are able to regularly Break Even.

Front-load the Etihad deal

As I outlined in the Notes, there is no rule to prevent the Etihad deal being front-loaded. Conceivably they could front-load the income and then re-negotiate the deal upwards in 4 or 5 years. UEFA have still to review the deal and although it seems unlikely that UEFA will reduce the contract value, their approach might well be different if the deal were front-loaded as a means of enabling City to navigate through FFP.

Sell Players to make up the deficit

Up to a point, this is possibly the best option for City. Any player who is sold for more than their book value (see Notes section on Amortisation) would deliver; profit, reduced amortisation and reduced wages (if not replaced). If City were, for example, to sell Tevez for £25m, Barry for £12m and Balotelli for £15m, the net benefit to City would be around £56m. However, if City would need to be careful as if they were to sell too many players then it could impact on the football and commercial success of the club. City have indicated that some player sales seem likely.

One problem for City may be the high wages of the players currently under contract. As we have seen with Adebayor, it can be hard to sell or even give away a player who is on higher than market-rate wages. With the advent of FFP we are seeing signs that clubs are starting to baulk at paying high transfer fees and wages.

There is an interesting dynamic to City’s need/wish to sell players. In order to sell players, you need a buying club. City aren’t at all popular in Europe (owing to their Wealthy Benefactor model). Now they have won the championship and seem set to dominate English Football, it will interesting to see if clubs decide that helping City’s FFP test by buying their players is not something they want to do.

Future Monitoring Periods

Although I have only projected City’s performance over the first Monitoring Period, the projected result for 2012/13 might give City some cause for concern. To meet the third Monitoring Period (which includes the 2012/13 season needs to average below £8m a season). The projected Break Even Deficit of £49m in 2012/13 exceeds the maximum permitted deficit for the entire third Monitoring Period (24m).

What Punishment would UEFA give to City?

I covered the arguments for leniency and also for giving a stiff punishment in an article on 19 April. There are 8 available punishments, include a Warning, a fine, a UEFA competition transfer ban and an outright ban. However UEFA have not yet issued a tariff to explain how the punishments will be applied and when.

Quite what punishment UEFA would hand out to City, if they fail to meet the test remains to be seen. City will be desperate to avoid a UEFA ban and almost any punishment is probably a comparatively good result. Interestingly, any punishment that withholds the Champions League revenue from the club (through a competition ban or a by withholding prize money) is self-fulfilling; the club would struggle to meet future FFP tests if they don’t receive the £25m to £50m of CL revenue. UEFA are also able to allow teams to compete in the competitions but deduct points from the Group Stage of the CL and Europa League – it is possible that UEFA may choose this punishment over an outright ban.

Financial Fair Play misconceptions

There has been some confusion about the FFP rules and the available exclusions. This is almost entirely due to something called Annex XI, a rather tortuously worded post-script added to the FFP rules to help clubs comply with FFP in the early years. The most common incorrect beliefs are:

| Incorrect FFP beliefs | |

| 1 | As long as the club is trending in the right direction and the losses are reducing, the FFP test is passed. |

| 2 | The wages of all players signed before 1 June 2012 are excluded from the calculations for every season |

I will explain why these are incorrect and I have attached the wording for Annex XI at the end of this section.

Annex XI Exclusion test

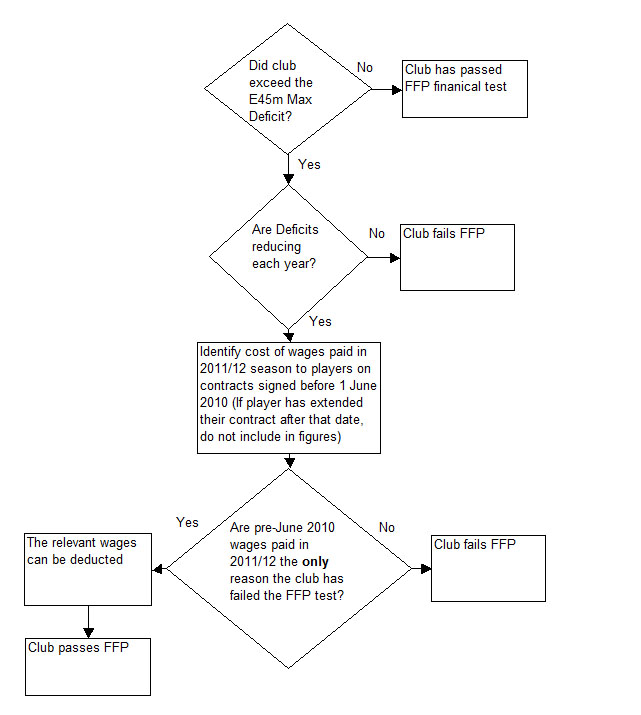

The paragraph is best explained in a diagram:

If clubs have Break Even Deficits trending in the right direction, the club can look to use Annex XI to help them pass the test. If losses are not moving in the right direction, and the club has deficits over the permitted limits, the club fail the test.

This potential exclusion only applies only to the wages for the long-standing players paid during the one season (2011/12).

On the my headline financial projection, technically, City would have actually failed the FFP test by £116.5m (the difference between £152.5m and the £36m maximum permitted deficit). This is because the club can only exclude 2011/12 wages if they wages are the only reason they fail the FFP test (and clearly they aren't).

So in summary; Clubs that exceed the permitted Break Even Deficit may be able to exclude wages paid in 2011/12 for long-standing players – and they can only do this if their Break Even Deficits are reducing each year. It relates to one-season's wages an trending in the right direction, in itself, is no help to the club.

One final piece on Annex XI. Although the Annex allows the club to exclude wages from players signed before 1 June 2010, there is another reading that could, potentially help clubs; the exclusion could also extend to amortisation. Again, this is not the generally accepted reading of this and it does not appear to have been UEFA’s intention to exclude both amortisation and wages on the long-standing player

UEFA FFP Wage Exclusion paragraph: Annex XI (page 85)

blog comments powered by Disqus