Will Liverpool face any FFP punishment?

Since Tuesday's release of Liverpool’s annual accounts for last season (2012/13), fans have been asking whether they will receive a punishment for breaching the Break Even rules. Unfortunately the FFP rules aren’t straight-forward and it is only when you produce a projection of this season’s finances that you can see how the land lies.

As I advised a couple of days ago, Liverpool will be assessed for FFP compliance over three footballing seasons - they will be able to compete in the Champions League next season (2014/15) and would only potentially receive punishment for any overspending once the campaign is over (i.e. in June 2015).

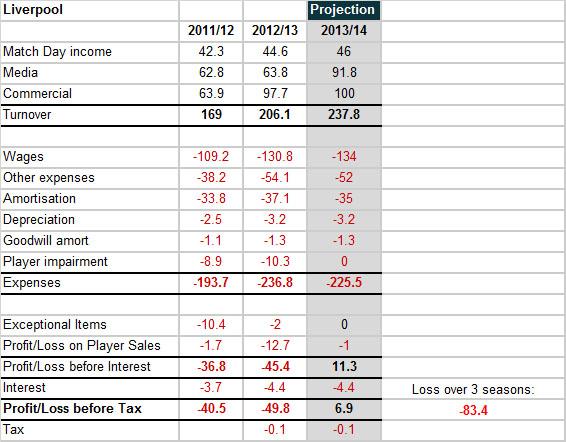

First of all, we need to look at the recent results and at a projection:

Liverpool made a pre-tax loss of £90.3m over the 2011/12 and 2012/13 season. However as Liverpool will be assessed over three seasons, the key figure here is the £83.4m loss (based on the 2013/14 projection). Before we look at what that means, I need to explain more about the 2013/14 projection.

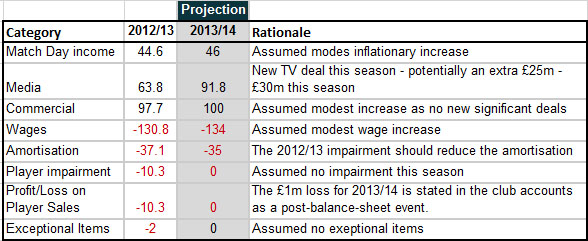

This account projection carries a health warning – however it will be broadly correct – and that is probably all we need for this exercise (as I will explain later). I should provide a rationale for some of the figures I have used for the 2013/14 projection:

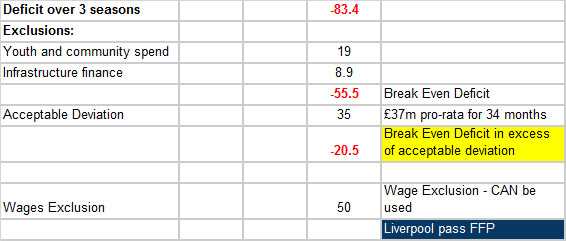

We now need to consider which of UEFA’s permitted exclusions can be applied in order to determine if the £83.4m loss figure will come below UEFA’s £37m (45m euros) maximum permitted deficit figure over the three seasons.

First of all, I should point out that Liverpool’s maximum loss target is actually £35m rather than £37m. This is because Liverpool’s 2011/12 accounts were over 10 months rather than 12. Where this occurs, the Break Even Deficit figure needs to be reduced to take account of the two ‘lost’ months (i.e. 34/36 x £37m =£35m).

So, let’s look at the application of the exclusions:

Obviously, readers will be drawn to the results of the analysis; “Liverpool pass FFP” – I will explain the exclusions and why Liverpool pass..

Youth and Community spend can be excluded. Community spend is given in the accounts and is around £300k a season. I am advised by a journalist close to the club that Liverpool expect to be able to deduct around £6m a season for youth spend.

Infrastructure financing costs can also be excluded. In Liverpool’s case this is essentially their Depreciation expenses.

So, on the face of it, Liverpool appear to have missed the target by £20.5m. HOWEVER, there is one final exclusion that rides over the hill to save the club. Under certain prescribed and rather complicated circumstances, a club can exclude a huge chunk of wages paid to players in the 2011/12 season. The good news for Liverpool is that the club meet the criteria for applying this exclusion.

The rules for when this exclusion can be applied can be found on page 93 and 94 of the UEFA’s FFP Toolkit found here. I should warn readers that it is a fairly hard read.

Essentially this wage exclusion allows the club to deduct wages relating to players on contracts before the FFP rules came in (end May 2010) – however it only relates to the wages paid in the 2011/12 season. It is hard to be precise but intuitively this should probably account for somewhere around £50m+ for Liverpool (given total wages was around £109m for that season).

This key exclusion can only be applied if the club’s recent accounts are trending in the right direction (which they clearly are) andthe excludable wages accounted for more than the 2011/12 deficit after exclusions and if the overall deficit (the red -£20.5 figure) is less the amount of potentially excludable wages paid in 2011/12.

So, despite losing £83m over three seasons, Liverpool can expect to have no sanctions imposed at the end of the 2014/15 UEFA campaign. However, I should point out that to pass FFP, Liverpool’s owner will still need to inject hard cash to cover losses made over the three seasons. For Liverpool, this means the owner needs to put his hand in his pocket and inject around £44m by 31 December 2014. This can’t be done via a loan and if he doesn’t do this, Liverpool could well face a UEFA ban in 2015/16. However there is no reason to believe that he won’t convert the required £44m of debt into equity.

In future years, Liverpool, like all PL clubs, shouldn't have too much trouble with the FFP criteria (even as the Break Even threshold gets reduced). The extra £20-30m a season TV revenue for the life of the current 3 year deal makes a huge difference. Also from 2015/16, the amount a club can expect to receive from the Champions League media payments is increased by around £15m. Given that the Premier League have now capped annual wage increases, to the greater of £4m a season or a club’s commercial income uplift (excluding PL TV revenue), in theory, clubs should be more sensibly run and fewer clubs should struggle with FFP compliance.

blog comments powered by Disqus