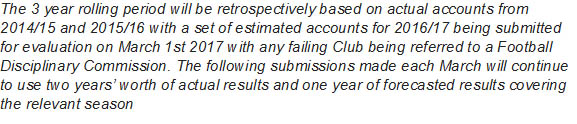

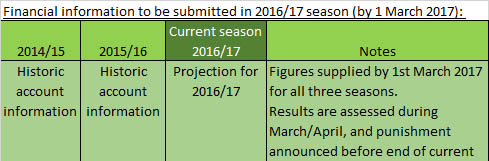

Last Friday UEFA held an FFP update in Nyon which provided some excellent information about the current process – however it also gave rise to a number of interesting questions.

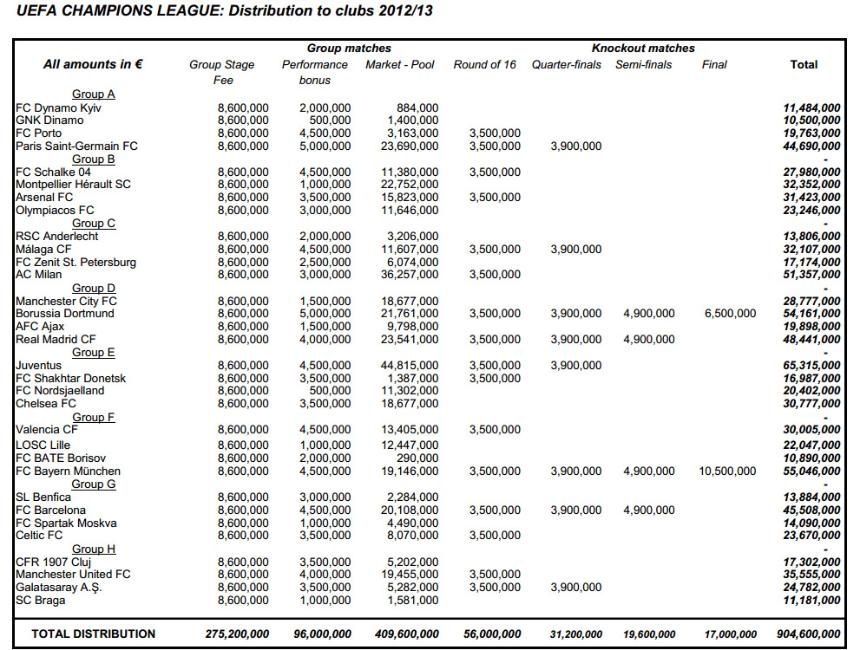

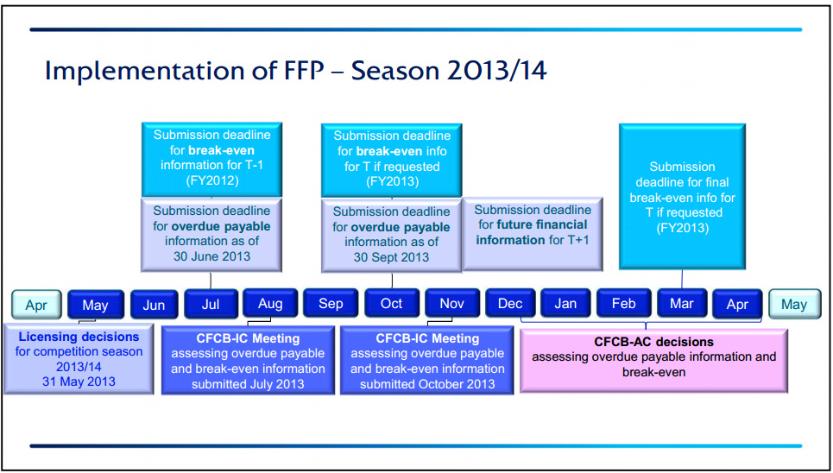

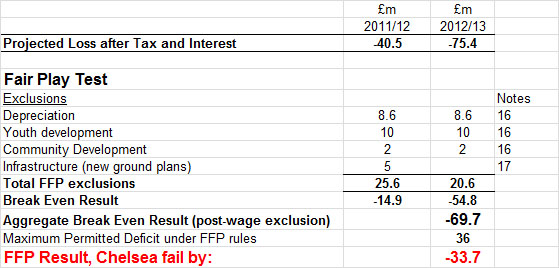

UEFA explained that the teams that potentially faced punished for an overspend during the first Monitoring Period are those professional teams that qualified for UEFA competition in 2012/13 and had a Break Even deficit in the 2011/12 season. Although the Monitoring Period looks at accounting performance over two seasons, only a 2011/12 deficit would trigger a need to look at the more recent accounts. For Chelsea, this means that they cannot be punished during the current Monitoring Period as they reported a small profit in 2011/12 - UEFA wouldn't have even asked for their 2012/13 accounts (although they will in June as part of next year's process).

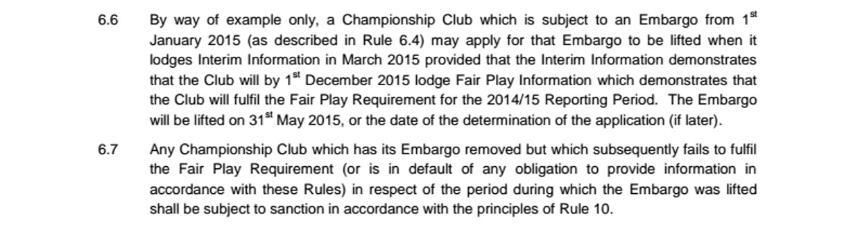

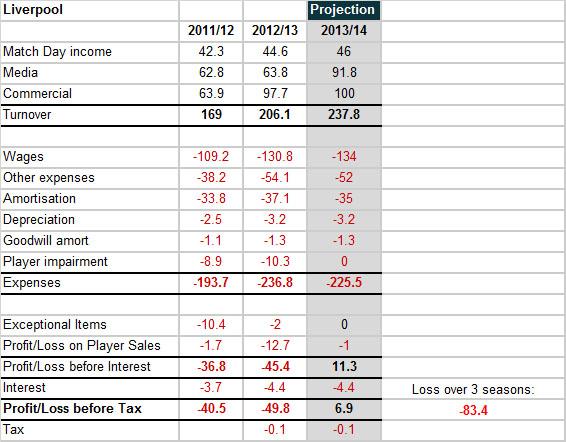

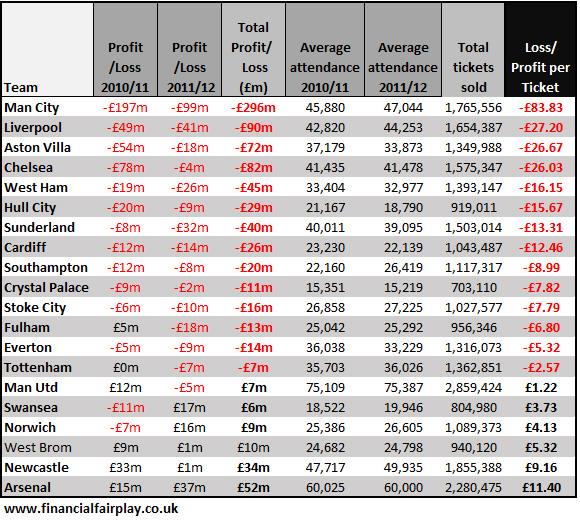

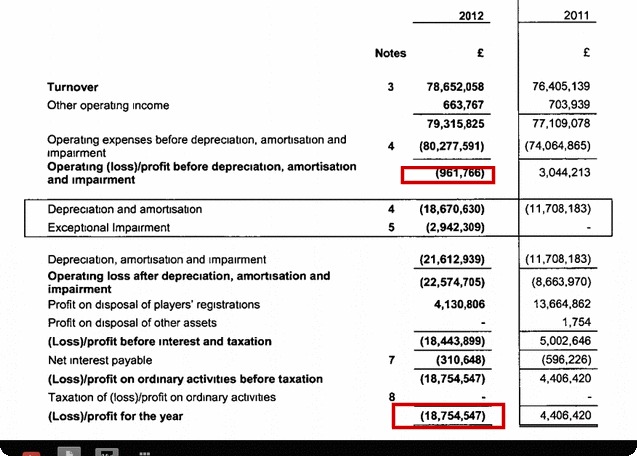

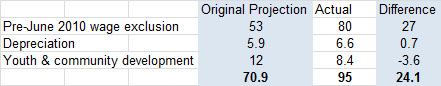

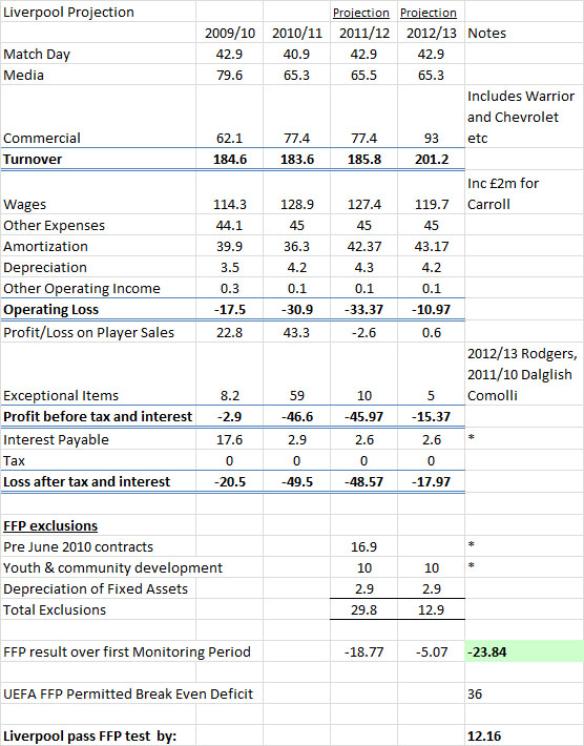

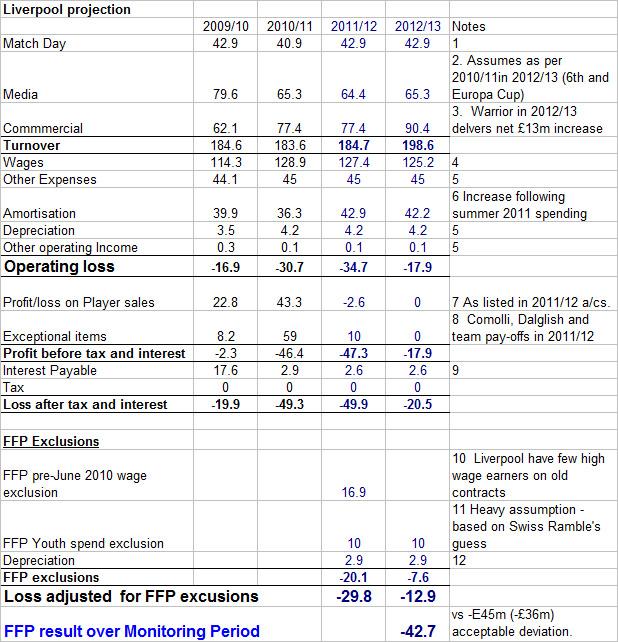

Liverpool’s recent accounts illustrate an interesting issue with the implementation of the FFP rules.

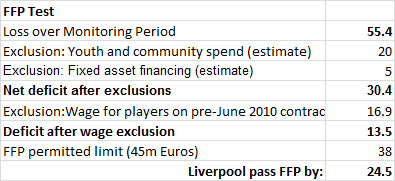

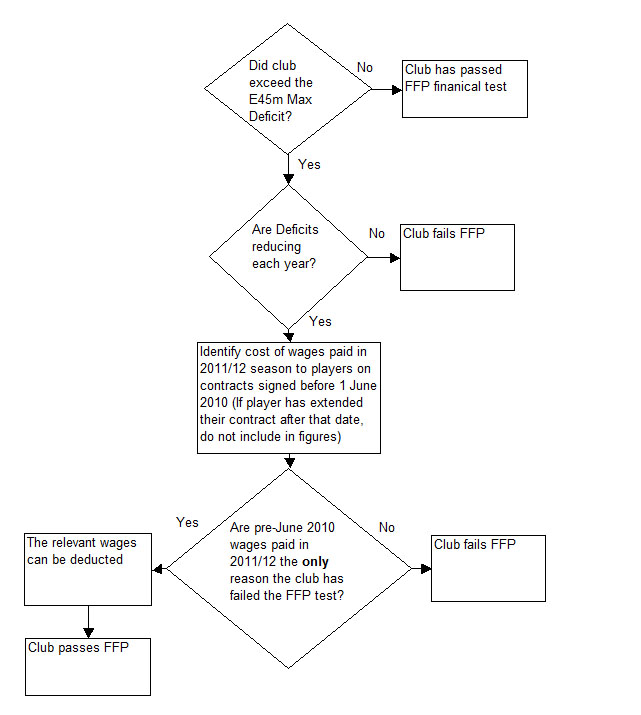

The Break Even rules essentially prevent clubs from overspending to gain entry into the UEFA competitions. However, Liverpool have clearly overspent during the 2011/12 and 2012/13 season combined – they have exceeded the maximum permitted deficit figure of 45m Euros (even allowing for permitted exclusions). Liverpool are effectively ‘saved’ (at least for now) by the fact that they did not take part in UEFA competitions in 2013/14. Consequently, their accounts were not submitted to UEFA and they are not one of the 76 clubs that are currently being investigated. Liverpool will therefore be free to take part in the 2014/15 competition without any immediate penalty.

This idiosyncrasy in the rules exists for purely practical reasons - UEFA would not have time to asses Liverpool's accounts from scratch between May and the end of June (the end date for advising of punishments). The club will, however, have applied for a UEFA License well in advance of the end of the season but the Break Even examination is a separate process. Clubs might fail the Licensing process if, for example, they are in administration or do not have audited accounts.

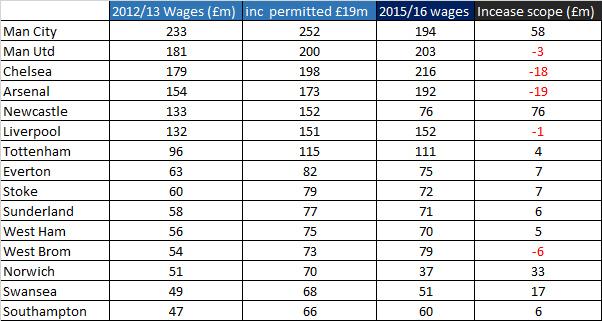

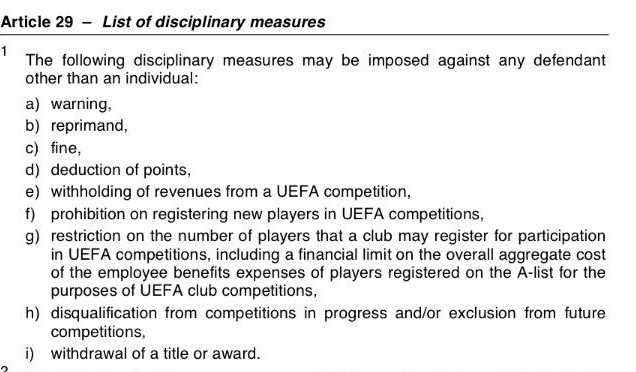

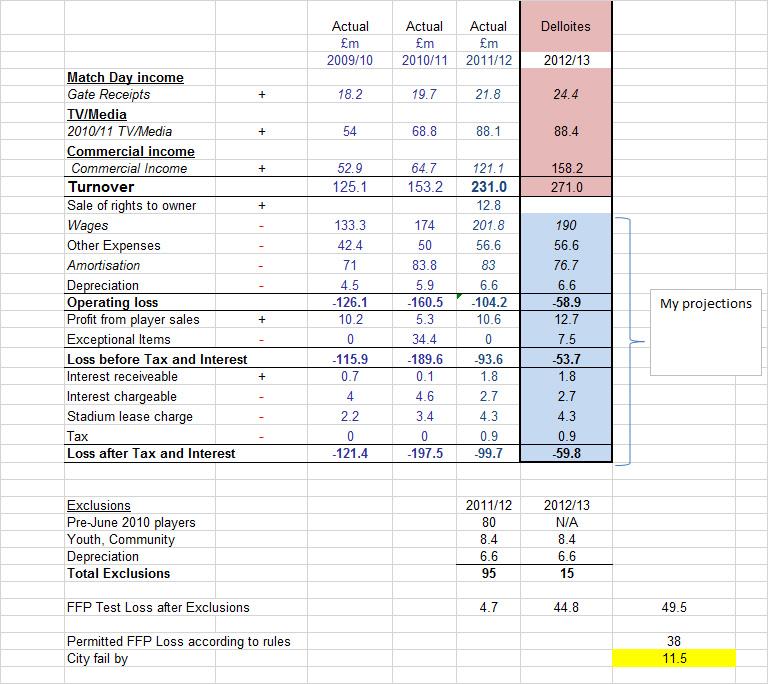

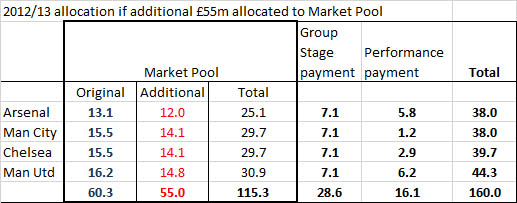

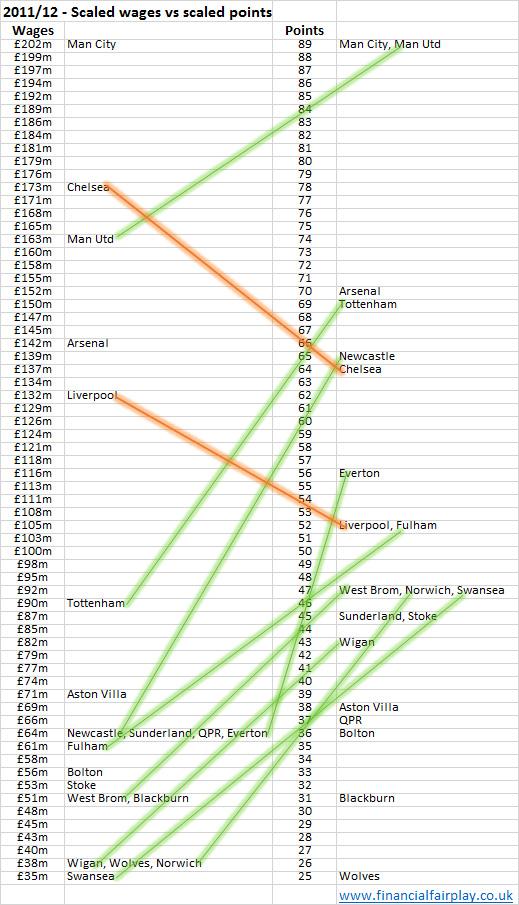

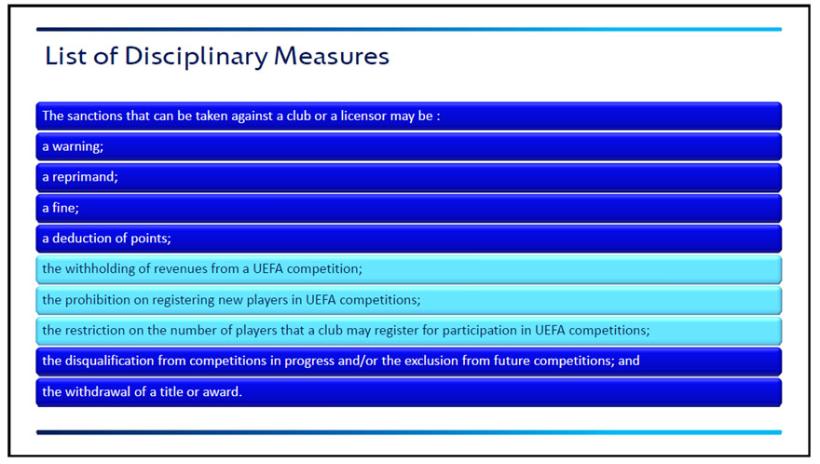

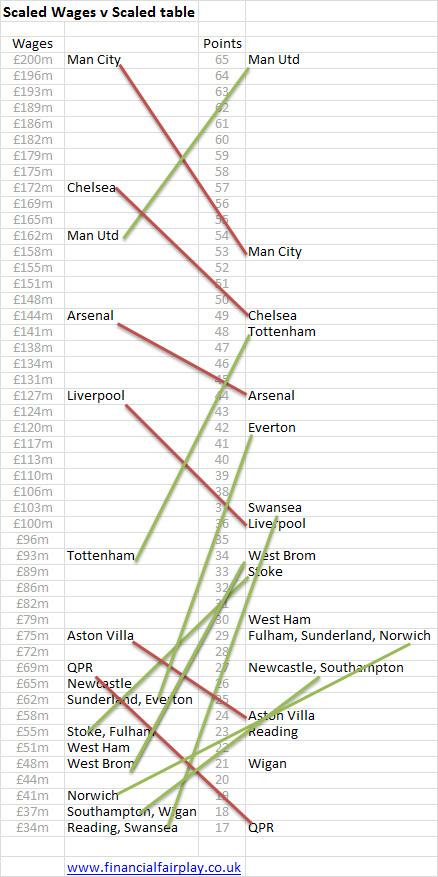

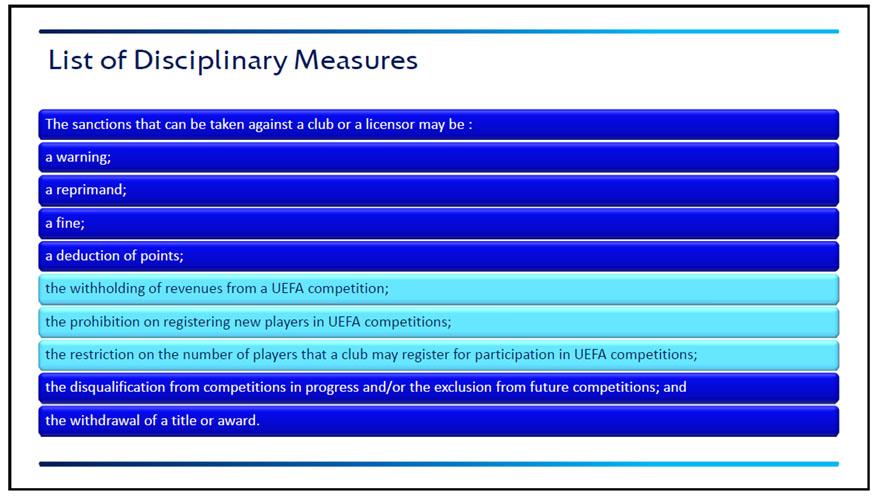

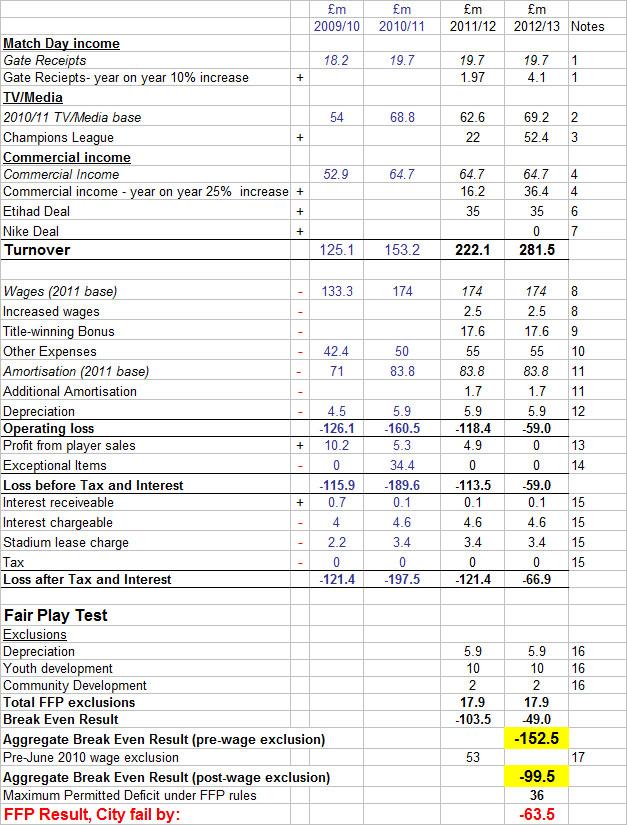

This is interesting because other clubs that overspent during the same two year period but whowere in European competition this season, can expect some kind of sanction. The CFCB Adjudicatory panel will disclose thei sanctions for the 76 currently being investigated, during the coming June – it seems likely that PSG and, I suspect, Manchester City will be amongst the clubs who receive some kind of punishment. These clubs could, potentially, be banned from the competition altogether or receive one of the other punishments – including the probable favourite sanction of capping the wage-spend for the UEFA competition squad. So, we could see Liverpool, with a full-strength squad, lining up against a weakened Man City or PSG – both would have overspent over the same period yet only one would have a restriction applied.

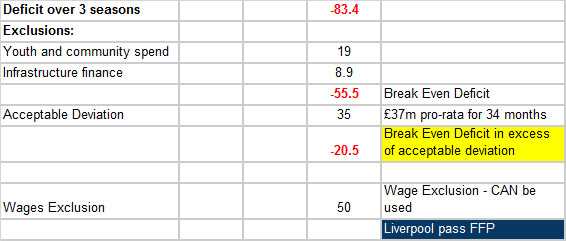

So what kind of punishment would Liverpool receive and when? Under the rules, Liverpool are likley to qualify for UEFA competiton so would have to supply their 2011/12 and 2012/13 accounts this coming July. These would clearly show that the club made a Break Even deficit and hence, during October 2014, UEFA would request the 2013/14 club accounts. Liverpool would clearly be assessed over the three seasons (2011/12, 2012/13 and 2013/4) and any punishment disclosed in July 2015 (assuming they had overspent over the three year period).

However what isn’t entirely clear is whether they would also be measured over two year periodand the three year period – I suspect that they would only face an assessment over the three years but to be sure I have asked UEFA for confirmation. This is potentially interesting because you could argue that it isn’t particularly ‘fair play’ when two clubs could overspend over an identical period and yet one play under an immediate sanction and the other not.

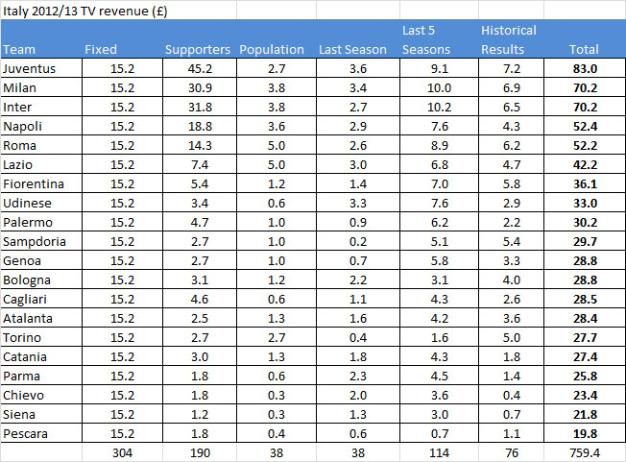

Of course, it isn’t just Liverpool who we need to consider here. The situation with Monaco is also interesting. Monaco are also not one of the 76 clubs currently being investigated as they were not in UEFA competition this season. Whereas Liverpool have made efforts to factor in FFP in how they manage their club, Monaco seem to have simply disregarded FFP altogether – they are set to finish runners-up in France and will miss Break Even by a wide margin. Yet it seems that Monaco will waltz into the Champions League and compete without any sanction at all until June 2015 at the earliest.

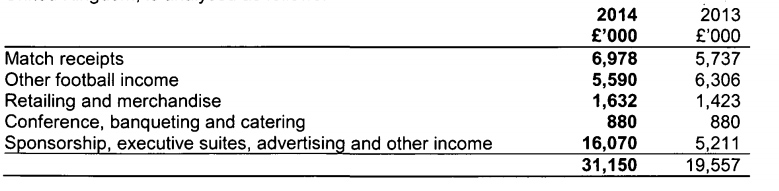

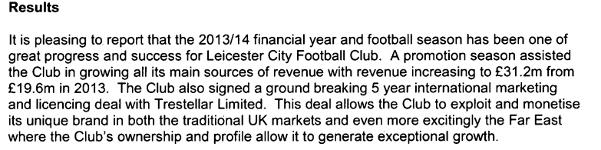

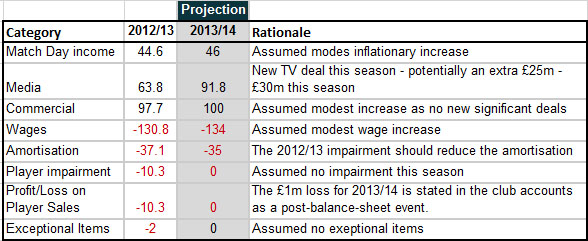

Alastair Bell (UEFA Director of Legal Affairs) explained on Friday that he did not expect any sporting sanctions to be applied mid-season. So when Monaco and Liverpool supply their accounts next October, they can expect to be able to continue in the competition. UEFA are able to withhold prize money and have used this sanction for clubs that have overdue payables (including overdue tax or transfer fees). However it looks more likely that Liverpool and Monaco would simply wait until the June 2015 sanctioning decision. It is of course possible that Liverpool might make sufficient profit this season to bring them back into FFP compliance and seemingly escape punishment altogether (although they would probably need to sell some players in May 2014 to make that happen).

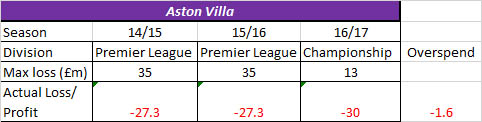

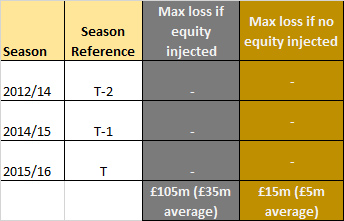

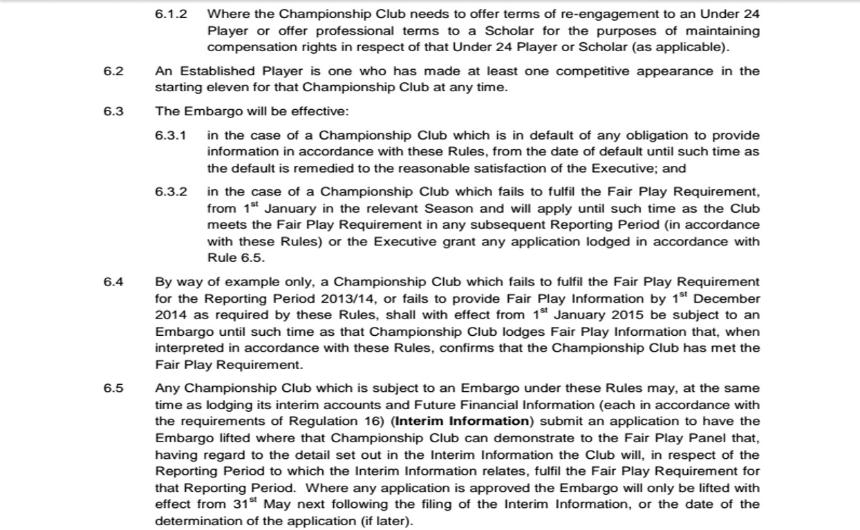

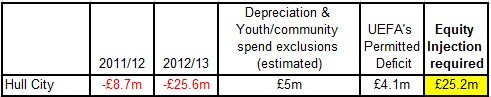

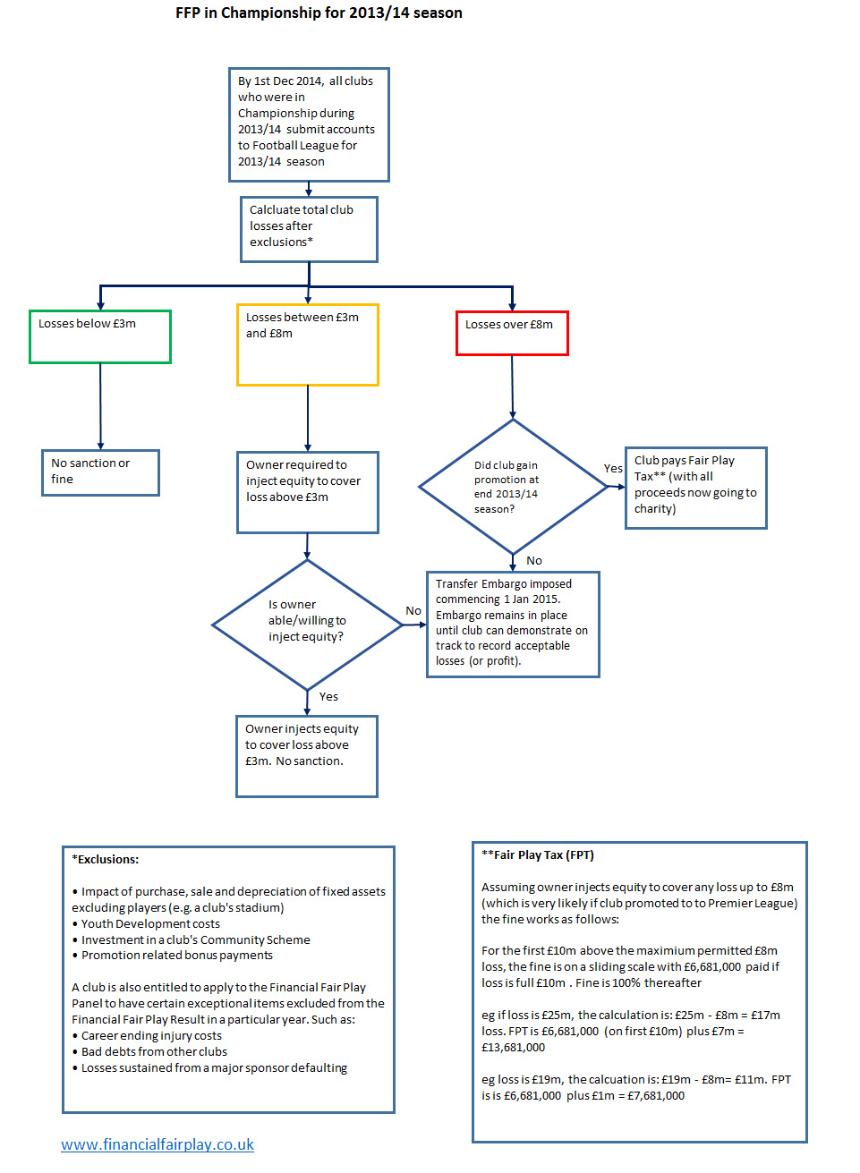

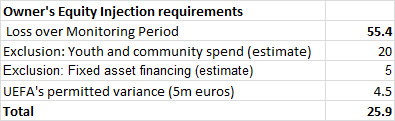

The application of the rules gives rise to a couple of other interesting issues. Hull City, Cardiff and Aston Villa appear to have failed the Break Even rules for the current two year Monitoring Period (for different reasons). As they didn’t take part in UEFA competition in 2013/14 all three will escape any sanction from UEFA. Cardiff and Hull City’s owners have failed to inject equity into the club to cover recent losses - however it appears that even if Hull were to qualify via the FA Cup this season, they would quite possibly escape punishment (as they would be assessed over a more favourable 3 seasons rather than two).

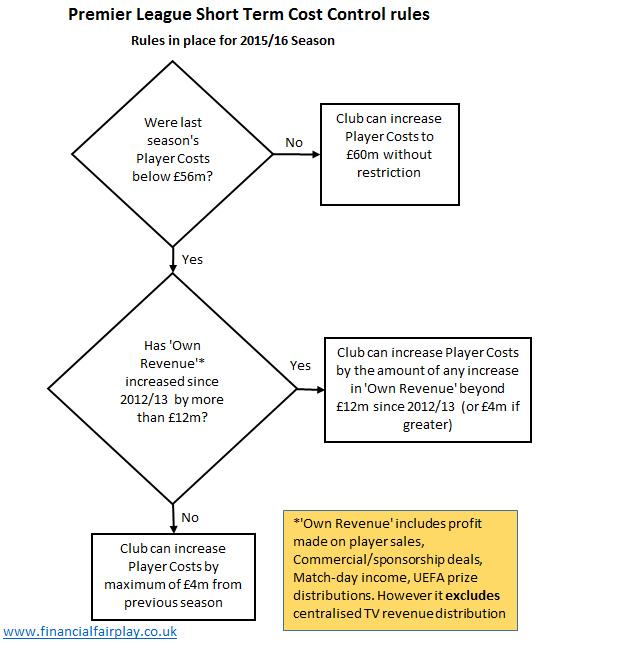

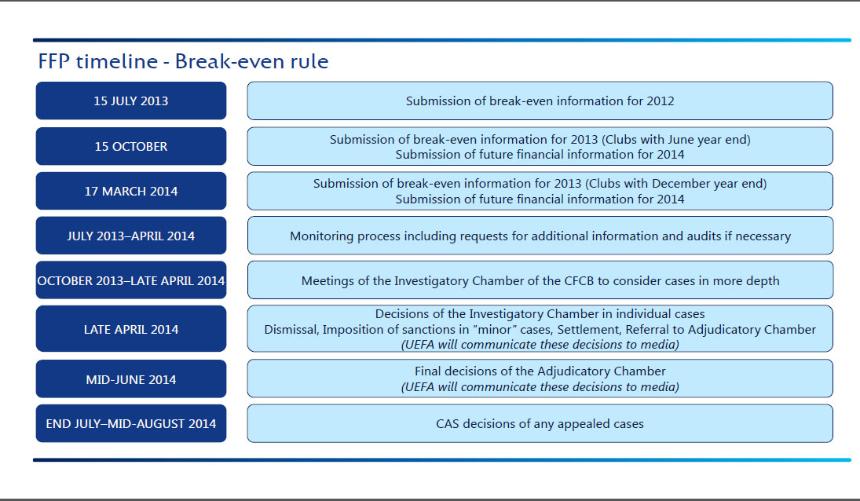

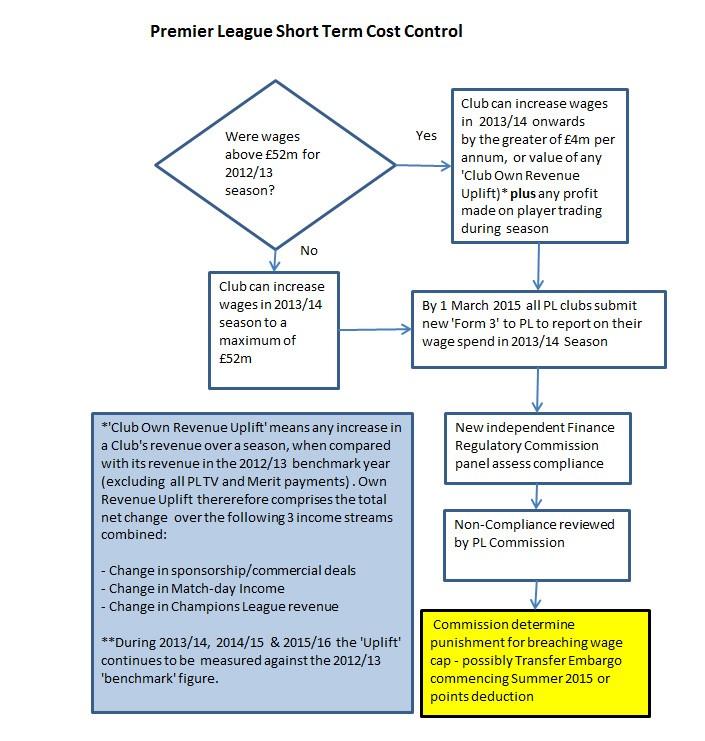

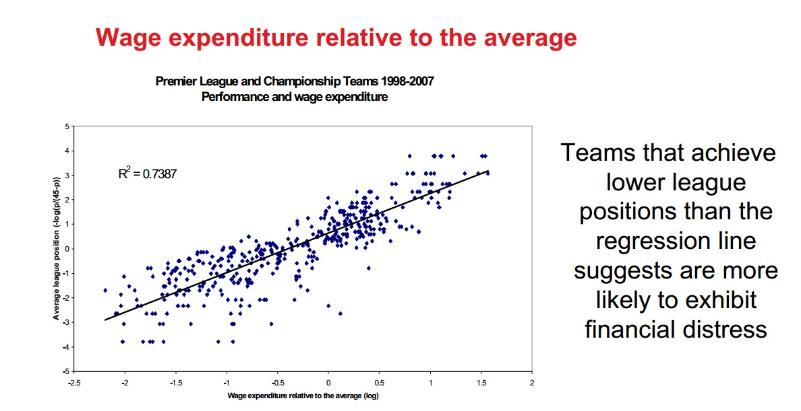

The practicalities are important - before the Premier League were rather forced to introduce spending constraints following parliamentary pressure, the Premier League had maintained that as all clubs aspire to take part on UEFA competition, no specific PL FFP was required. However as we can see from Villa, Cardiff and Hull, these overspending clubs did not receive any immediate UEFA sporting sanction – the government was perhaps wise to press for those spending constraints.

It is worth reading Ben Rumsby’s piece on this – he attended the UEFA session and also understands that Liverpool will face the three-year test.